The 20-Second Trick For Clark Wealth Partners

Table of ContentsClark Wealth Partners Things To Know Before You Get ThisA Biased View of Clark Wealth PartnersWhat Does Clark Wealth Partners Do?Not known Factual Statements About Clark Wealth Partners Indicators on Clark Wealth Partners You Should Know9 Simple Techniques For Clark Wealth PartnersGetting My Clark Wealth Partners To Work

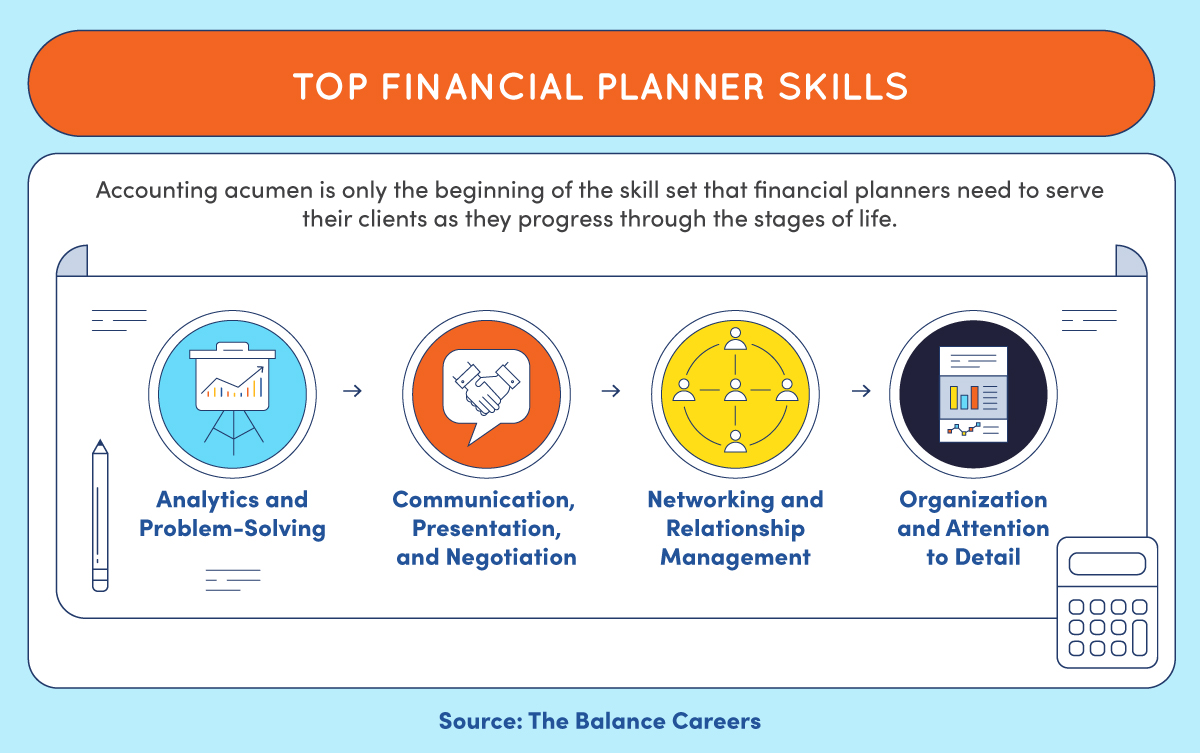

The globe of money is a complicated one., for example, lately located that almost two-thirds of Americans were unable to pass a basic, five-question monetary literacy test that quizzed participants on subjects such as interest, financial debt, and other relatively fundamental ideas.Along with handling their existing clients, financial consultants will certainly usually invest a reasonable amount of time weekly meeting with potential customers and marketing their services to maintain and expand their company. For those considering becoming an economic expert, it is necessary to consider the typical wage and job stability for those operating in the area.

Programs in taxes, estate planning, investments, and risk monitoring can be helpful for trainees on this path too. Relying on your unique job goals, you may additionally require to make details licenses to fulfill certain clients' requirements, such as purchasing and offering supplies, bonds, and insurance coverage. It can likewise be practical to gain an accreditation such as a Qualified Economic Coordinator (CFP), Chartered Financial Expert (CFA), or Personal Financial Expert (PFS).

The Single Strategy To Use For Clark Wealth Partners

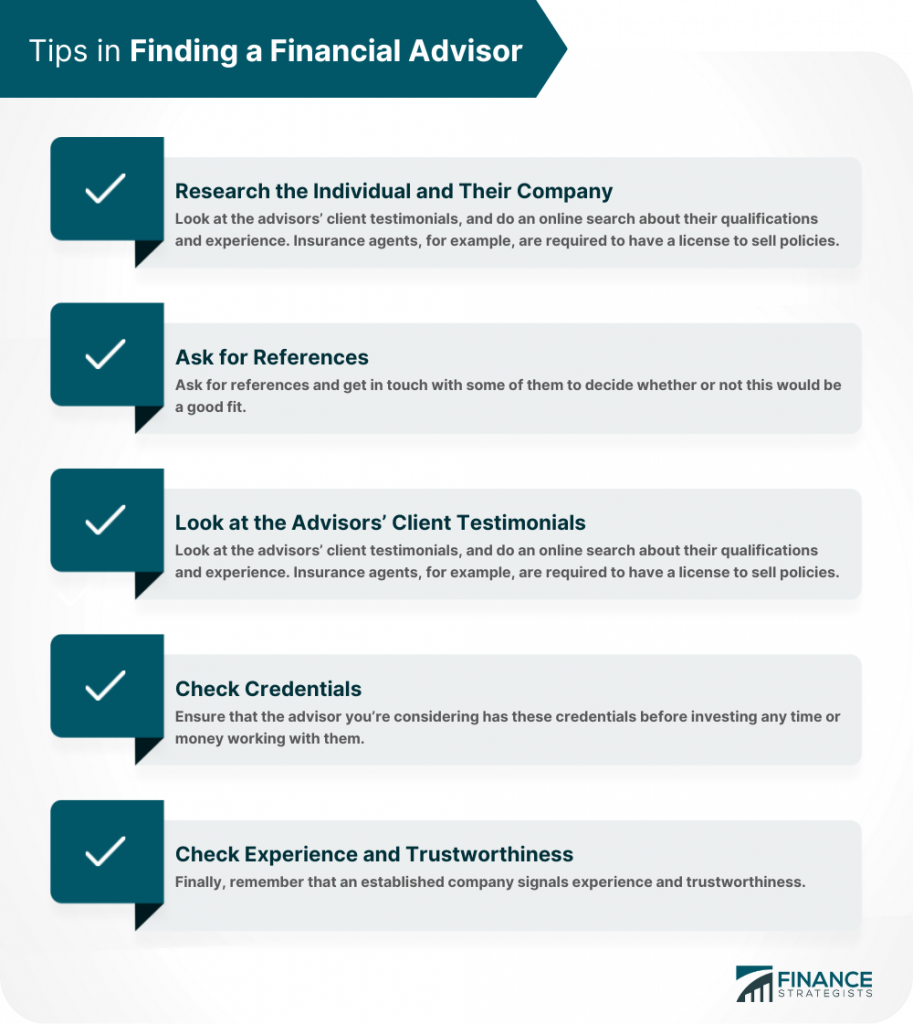

Numerous people decide to get aid by utilizing the services of a monetary specialist. What that looks like can be a number of things, and can differ depending upon your age and stage of life. Before you do anything, research is essential. Some individuals stress that they require a particular amount of cash to invest before they can obtain help from an expert.

Clark Wealth Partners Things To Know Before You Buy

If you haven't had any type of experience with a financial consultant, right here's what to expect: They'll start by offering a comprehensive assessment of where you stand with your assets, obligations and whether you're satisfying criteria compared to your peers for cost savings and retired life. They'll review brief- and lasting objectives. What's useful about this action is that it is individualized for you.

You're young and working complete time, have a car or 2 and there are student loans to pay off.

Get This Report about Clark Wealth Partners

You can talk about the following best time for follow-up. Financial consultants generally have various click for more info rates of rates.

You're looking ahead to your retirement and assisting your youngsters with greater education prices. A financial consultant can supply guidance for those scenarios and even more.

How Clark Wealth Partners can Save You Time, Stress, and Money.

That could not be the ideal method to maintain building wide range, especially as you progress in your career. Schedule normal check-ins with your planner to fine-tune your plan as required. Balancing savings for retired life and university costs for your children can be complicated. A financial advisor can help you focus on.

Considering when you can retire and what post-retirement years might look like can generate problems regarding whether your retirement financial savings are in line with your post-work plans, or if you have actually saved sufficient to leave a heritage. Aid your monetary professional understand your method to cash. If you are much more traditional with conserving (and prospective loss), their ideas need to reply to your concerns and concerns.

Clark Wealth Partners - The Facts

Intending for health and wellness treatment is one of the large unknowns in retired life, and an economic professional can lay out options and recommend whether added insurance as security may be useful. Prior to you begin, try to get comfy with the concept of sharing your entire financial image with a specialist.

Offering your professional a complete image can aid them develop a strategy that's focused on to all parts of your monetary standing, especially as you're rapid approaching your post-work years. If your funds are simple and you have a love for doing it yourself, you may be fine on your own.

A monetary consultant is not only for the super-rich; any person dealing with major life shifts, nearing retirement, or sensation bewildered by monetary decisions might take advantage of professional support. This article checks out the duty of monetary consultants, when you might require to consult one, and vital considerations for selecting - https://www.twitch.tv/clrkwlthprtnr/about. A financial advisor is a trained expert who aids clients manage their financial resources and make informed choices that line up with their life goals

The Main Principles Of Clark Wealth Partners

In contrast, commission-based experts make revenue through the economic products they sell, which may influence their referrals. Whether it is marriage, separation, the birth of a child, job modifications, or the loss of a liked one, these events have distinct monetary implications, frequently calling for prompt decisions that can have long lasting results.